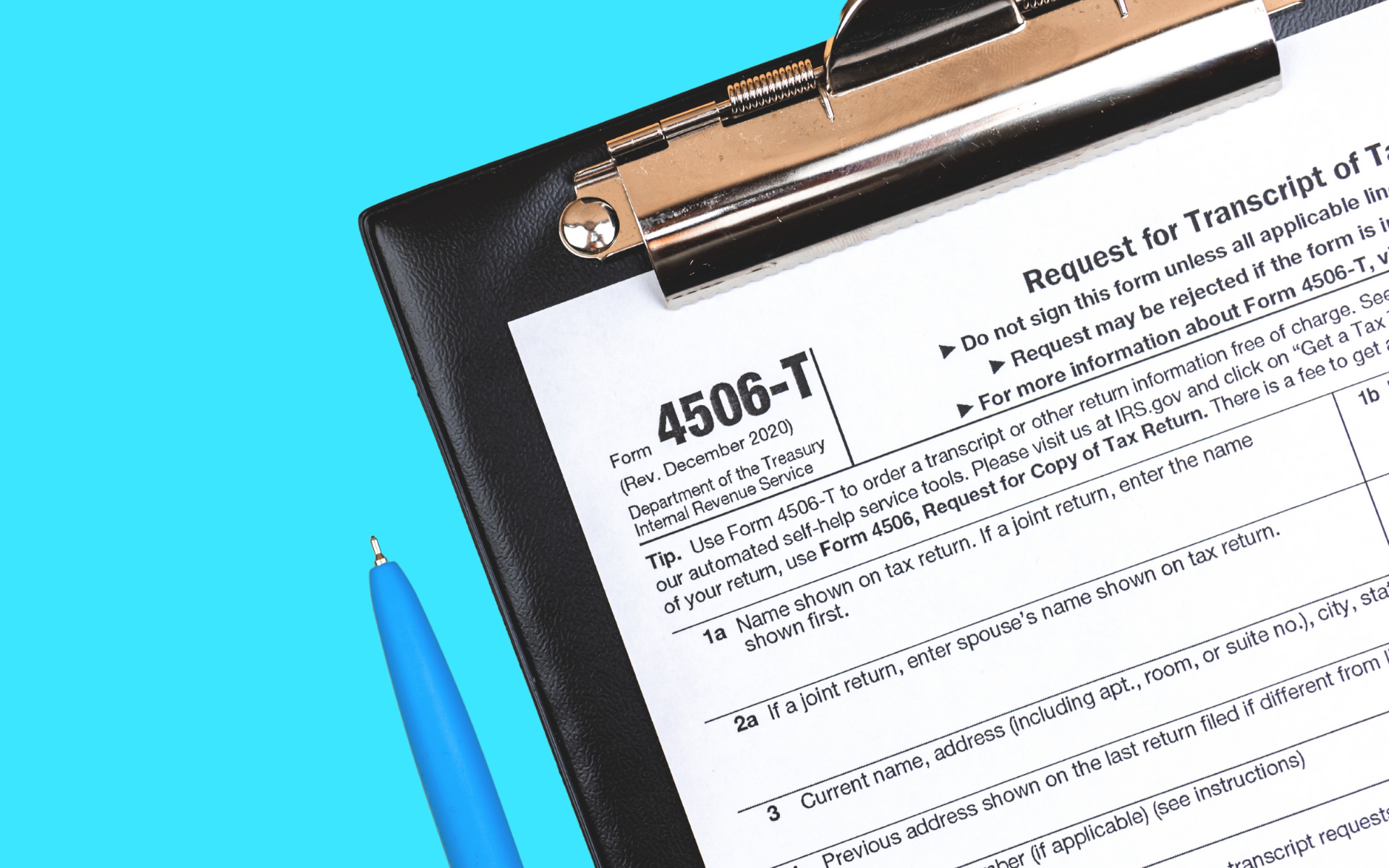

If you want to obtain a copy of your tax return, form 4506-T is an essential tool. This form authorizes the Internal Revenue Service (IRS) to release your tax transcripts or other tax return information to third parties.

Fortunately, we’re here to provide you with a step-by-step guide on how to draft IRS form 4506-T. We’ll cover the standard components of the document, common mistakes to avoid, and our selected best practices. We’ll also show you how to utilize the eSignature app Fill to create your form 4506-T quickly and easily.

How to Write 4506-T Forms: A Step-by-Step Guide

Follow these steps to receive a copy of your tax return from the IRS:

1. Obtain the form

The first step is to download form 4506-T from the IRS website or obtain a copy from your tax professional. You can also access a free form 4506-T template from Fill’s extensive library.

2. Fill in the basic information

The form requires basic information such as your name, address, and Social Security Number (SSN). Be sure to double-check your data to avoid any errors that could lead to a delay in processing your request.

3. Choose the transcript type

There are four types of transcripts that you can request using form 4506-T. These include the following:

- Tax return transcript

- Tax account transcript

- Record of account transcript

- Wage and income transcript

Choose the type of transcript you need based on your specific situation.

4. Provide third-party authorization (if applicable)

If you need to authorize a third party to receive your transcripts, provide their name and address in the appropriate section.

5. Sign and date the form

Sign and date the form in the appropriate sections. If you are signing on behalf of a business, include your title or capacity in which you are signing. It would also be more convenient to use a dedicated eSignature app like Fill to sign your form electronically.

6. Submit the form

Mail or fax the form to the appropriate IRS office near you. The document should contain the proper address and fax number.

Standard Components of a Form 4506-T

The form 4506-T consists of the following elements:

- Personal information: This section includes your name, address, and social security number.

- Transcript type: Choose the type of transcript you need according to the guide in the previous section.

- Third-party authorization: As mentioned, if you must authorize a third party to receive your transcripts, provide their full name and address.

- Signature and date: Sign and date the form in the appropriate sections. Use an eSignature platform for more convenience.

Best Practices For Drafting 4506-T Forms

When writing IRS form 4506-T, several best practices can help ensure your request is processed quickly and accurately. Here are some additional tips to keep in mind:

1. Be specific about the transcripts you need

It’s crucial to choose the type of transcript that best fits your needs, whether it’s a tax return transcript, tax account transcript, record of account transcript, or wage and income transcript. Make sure you clearly indicate the type of transcript you request on the form.

2. Provide accurate third-party information (if applicable)

If you authorize a third party to receive your transcripts, ensure that you provide accurate information about the individual or organization. This part includes their name, address, and any other relevant information.

3. Be consistent with the information on your tax return

Ensure that the information on your form 4506-T matches the data on your tax return. This information includes your name, address, and SSN. If there are any discrepancies, this could cause a delay in processing.

4. Double-check your information

Before submitting the form, double-check the information to guarantee it is accurate and complete. View your personal information, the type of transcript you request, and any third-party information you have provided.

5. Seek professional assistance if necessary

If you have any questions about filling out the form or which transcripts you need, it’s always a good idea to consult a tax professional or contact the IRS for assistance. This step can help ensure your request is processed correctly and immediately.

Utilizing Fill For Your Form 4506-T Creation

With Fill’s eSignature app, you can easily create and fill out your form 4506-T online. Fill’s template library includes form 4506-T, so you can easily access and fill out the form online. Plus, Fill’s intuitive platform ensures you can do this effortlessly.

Use Fill to obtain your tax return now and get started for free.