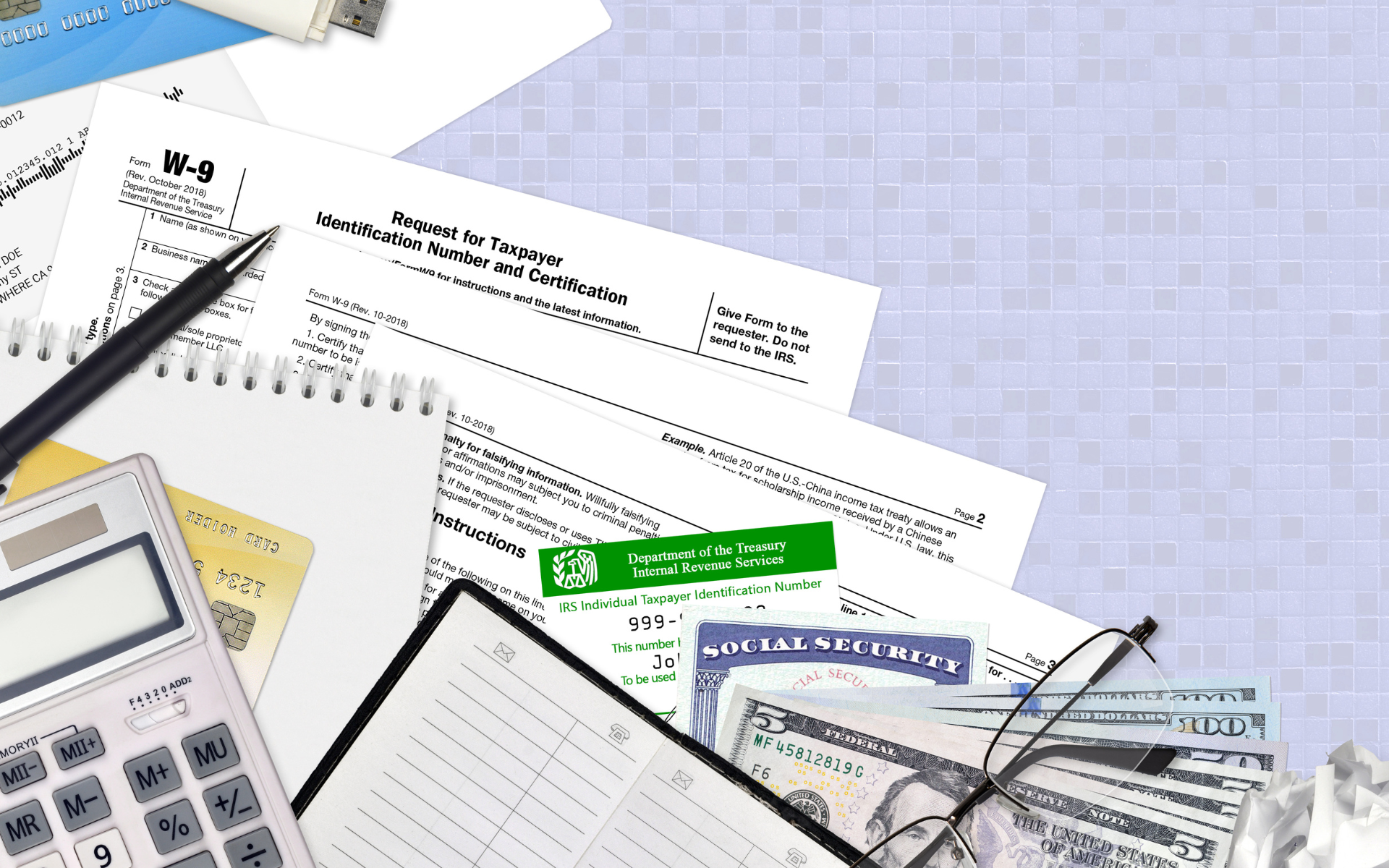

The IRS requires everyone to be diligent in paying their taxes. Non-U.S. citizens can also file an ITIN using Form W7. But do you know how to create Form W7 on your own? By the end of this article, you’ll be able to achieve this. We’ll also be guiding you to a site where you can use a template for the form.

Let’s dive in.

Table of Contents

How to Write Form W7 Application for IRS Individual Taxpayer Identification Number

Before anything, let’s talk about what Form W7 is.

The ITIN stands for Individual Taxpayer Identification Number. This is a tax processing number that contains nine digits. Through it, non-citizens can file a tax return to the IRS.

These are the common reasons why an ITIN is needed:

- If you don’t have an SSN and you’re not eligible to get one

- You need to file a federal tax return or get a federal TIN

The good news is that applying for an ITIN isn’t a complicated process. You simply need to submit Form W7 to get your application started. Here are the steps to Form the W7 creation process:

1. Identify why you need an ITIN

Will you be applying for a new ITIN? Or do you need to renew an existing ITIN that is about to expire? The form contains various reasons why you are filling out the form. Some common causes include the following:

- You are a non-resident who needs to get an ITIN so you can claim a tax treaty benefit.

- You are a non-resident who needs to file a US tax return.

- You are a US resident (based on the days you are present in the US). And you need to file a tax return.

- You are either a dependent or the spouse of a US citizen.

- You are a non-resident student, professor, or researcher who needs to claim an exception or file a tax return.

- You are a spouse or dependent of a non-resident alien who is holding a US visa.

Once you belong in any of these categories, you can proceed with completing the form.

2. Provide your necessary information

The usual information that will be required in form W7 includes the following:

- Your name

- Your mailing address

- Your foreign (non-US) address

- Your birth information

- Other necessary details (country of citizenship, supporting documentation, and others)

- Your signature

Make sure to include these details when you’re writing Form W7 so that it can be processed right away.

Free Form W7 Application for IRS Individual Taxpayer Identification Number Template

Once you’re ready to complete your details on Form W7, you will need to have access to the template. Fill has a gallery of templates that you can use to help you out.

Since W7 can’t be filed electronically, you can use the template to save time in drafting the necessary information. When you’re done with that, you will need to submit it together with Form 1040. Mail these together to the IRS.

Some other information you need to know about form W7 includes the following:

- The due date for W7 application filing is similar to a normal tax return. You will need to submit your application on April 15th. You may incur penalties or interest if you file the form late.

- Once the IRS receives your W7 application, it will take around seven weeks to complete the process. You should receive an update on the status of your application by the 10th week.

- It’s also worth noting that ITIN numbers expire. So, if you plan to file taxes for several years, you may need to keep drafting form W7 for yearly renewal.

Form W-7 – Application for IRS Individual Taxpayer Identification Number

What to Include When Writing a Form W7 Application

Now that you know the importance of Form W7 and its purpose, you can start preparing the necessary details. In a nutshell, you will need to prepare this information for your submission:

- Why you need an ITIN

- Your name, mailing address, and a foreign address (if applicable)

- Your birth date and location of birth

- The country where you are a citizen

- Your foreign tax ID number, if you have one

- Your US visa number (if applicable)

- Details regarding the submitted documents to verify your identity

Utilizing Fill for Your Form W7 Application for IRS Individual Taxpayer Identification Number

One of the easiest ways to learn how to draft form W7 is by heading over to Fill. Through this website, you can create an account and use the different templates available.

This will allow you to save time and energy in completing form W7.