Studies show that the biggest reason why people dislike or hate doing their taxes is because it is too complicated and requires too much paperwork. Part of this is because they find the different forms too much to learn. If you are an investor or trader, there is one such form that you should know about, Form 6781.

This article will teach you what you need to know about this form and the basics of writing Form 6781 and filing it. Keep reading for more information.

Table of Contents

How To Write A Form 6781

Now that you know what Form 6781 is for, the next thing to do is to know how to write an IRS Form 6781. There are three parts of the form that you need to know about. These include:

- Part I – You will need to report Section 1256 investment gains and losses at either the actual price you sold these investments for or its established mark-to-market price on December 31st.

- Part II – You will need to include the reported losses on the trader’s straddles from Section A as well as the reported gains from Section B.

- Part III – This part of the form is provided for any of your unrecognized gains on positions at the end of the tax year. However, this section only needs to be completed if you recognized a loss in a position.

Download the Form 6781

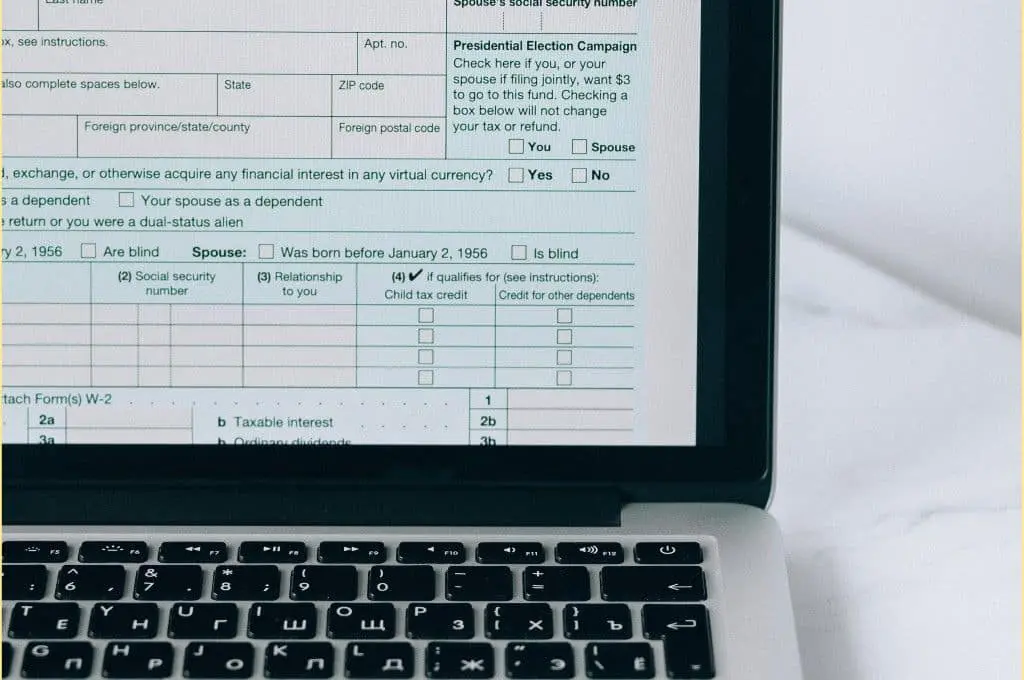

Below is a preview of Form 6781. Use this form for free when you sign up for a Fill account.

Form 6781 – Gains and Losses From Section 1256 Contracts and Straddles

What To Include When Writing A Form 6781

When you are drafting IRS tax Form 6781, you need to include the following information:

- Gains and losses – The gains and losses you encounter from straddles or financial contracts labeled as Section 1256 contracts need to be reported in Form 6781.

- Mark-to-market – You need to report the actual or potential gains and losses until the end of the year on the form. You can assign fair market value to investments you continue to hold and opt not to sell as “mark to market.”

- Long-term and short-term gains – No matter how long you hold a gain or loss, every Section 1256 is always 60% long-term and 40% short-term. The basic difference between the two is that long-term gains are held for longer than a year and have better advantageous tax characteristics.

- Separate sections – There is a separate section for Section 1256 contracts and straddles. Make sure you separate these too.

- Your personal information – You also need to include your full legal name, contact information, and taxpayer identification number on the form.

Recommended Strategies When Writing A Form 6781

When you’re trying to learn how to draft Form 6781 IRS on your own, you must follow some best practices so your entry won’t be considered invalid. Here are some things you need to remember:

- Keep things organized – The information you include in Form 6781 should be organized into lists and paragraphs. This way, you can easily fill out the form and the IRS can also better understand the information you provided.

- Be accurate – When you are reporting your gains and losses, make sure to be accurate about them— whether they are actual or would-be figures.

- Know what mark-to-market is – Mark-to-market refers to the process of assigning fair market value to an investment that you continue to hold and opt not to sell. You will need to report gains and losses from these on the form.

- Follow instructions – The best way you can accomplish your tax Form 6781 creation is to make sure you carefully follow the instructions specified on the form. You need to fill out the form correctly and ensure that you submit it to the IRS promptly so you do not have to worry about incurring any penalties.

How To Use Fill To Write Form 6781

You don’t have to learn how to create Form 6781 by yourself. You can use online tools and services to help you draft this IRS tax form. These tools will not only save you time and money, but they can also reduce your errors in drafting the form.

Fill is a contract management software that offers several IRS templates and forms that you can use. Sign up for free today to take a look at our templates.