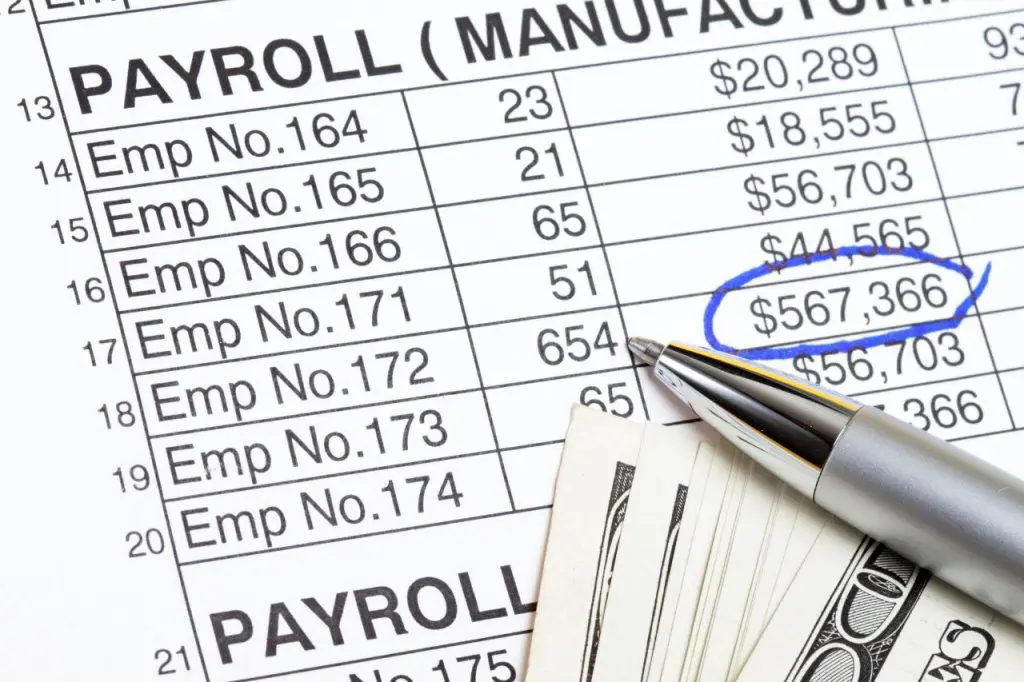

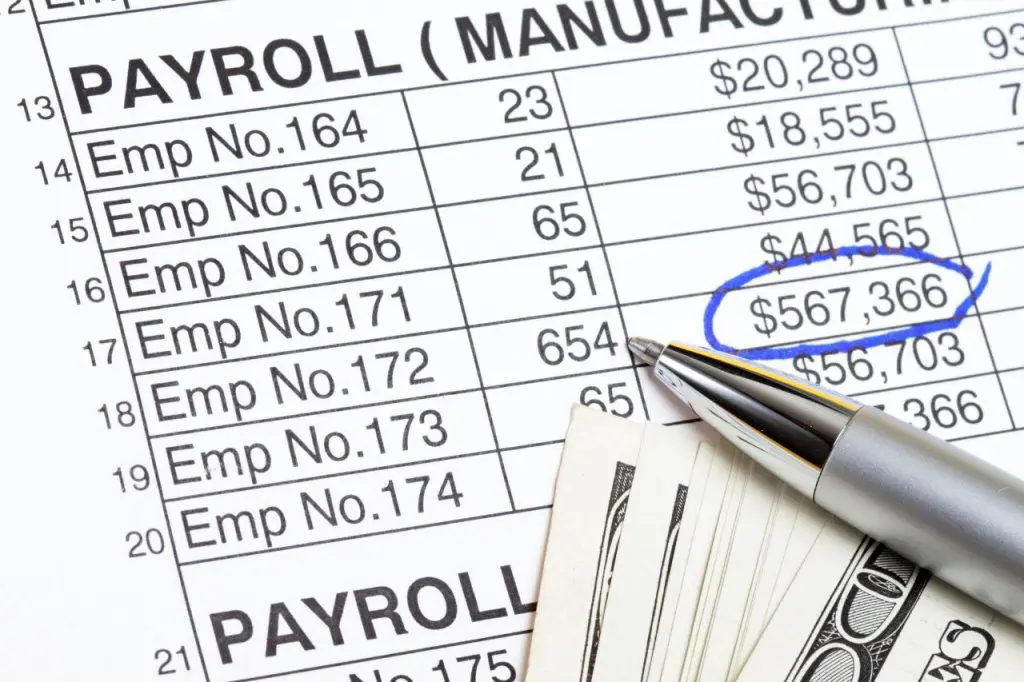

One of the critical tasks of the human resources (HR) department is maintaining accurate payroll records. However, managing a large volume of data requires due diligence. To meet compliance requirements, you must collect data, sign documents, and keep track of employee information regularly.

It’s a laborious process if you do it manually or on paper. Thankfully, an electronic signature provides a secure way to simplify the workflow. HR personnel can obtain authorization and confirmation from employees.

In this article, let’s understand the value of using electronic signatures for payroll. Get practical advice on how to simplify the process in your business.

Brief Overview of Using eSignatures for Payroll

eSignatures are one of the most popular methods of signing payroll documents. They offer fast and secure ways to manage documents and expedite payment processing.

With eSignatures, companies can approve payroll information faster with just a few clicks. In addition, electronic signatures provide much more security than traditional methods since the documents are highly encrypted and protected in the cloud.

The best part? No matter where you are, you can request eSignatures from employees and contractors. Most eSignature platforms are accessible via web apps. As long as you have an internet connection, you can enjoy the services at full scale.

How Payroll eSignatures Work

How Payroll eSignatures Work

Payroll eSignatures use electronic paperwork to speed up the sign-off process. This streamlines the tedious task of manually scanning, signing, and approving employee timesheets and compensation forms.

Most often, electronic signatures are powered by an application or web portal. The service prompts employees to click a checkbox or add their signature to documents. For example, within minutes of electronically signing payroll withholding forms, businesses can have time-sensitive salaries paid on time.

Thanks to this technology, payroll expenses are kept secure and accurate. It also reduces the risk of operational fraud associated with physical signatures.

Benefits of Optimizing Payroll Processes With eSignatures

Processing payroll is more efficient than ever when you take advantage of eSignatures. Here are four benefits.

1. Improved accuracy and reduced errors

eSignatures eliminate manual entry errors and speed up the approval process, reducing the risk of human error. Payroll administrators can securely collect approvals from all team members quickly, easily, and accurately.

2. Enhanced compliance

eSignatures help ensure compliance with applicable laws. They provide an audit trail of all signed documents and complete visibility into who has access to what information at any given time. Premium eSignature platforms offer role-based access control (RBAC) to restrict system access from unauthorized users.

3. Increased efficiency and employee satisfaction

Employees no longer worry about lost or misplaced paperwork being sent offsite for processing. They simply sign electronically from anywhere at any time, leading to greater efficiency in the workplace. This will also affect their level of satisfaction. No more waiting for papers to be processed manually or delivered back and forth between various locations or departments.

4. Strong security measures

eSignatures are digital alternatives for traditional handwritten signatures on official payroll documents. You can use them to verify the identity of the signee. One of the ways eSignatures strengthens payroll processes is the use of biometric authentication.

It requires users to provide biometrics, such as a fingerprint or facial scan, before accessing their documents. This ensures that only authorized personnel can access sensitive payroll data.

Best Practices for Selecting an eSignature Solution for Payroll

The right technology can make all the difference between efficient payroll management and costly errors. When selecting an eSignature solution, you should consider features such as:

1. Ease of use

A seamless user experience is essential to keep HR operations running. The eSignature platform should be user-friendly enough that employees can easily access the necessary documents. This will decrease the delays as they can attach signatures without the guesswork.

2. Customization capabilities

This allows organizations to customize their experience with the eSignature tool such as:

- company name

- custom fields for collecting more data

- graphics

- company logo

Always check what’s included in the customization option. As a result, HR teams have control over how documents appear when being sent out and how they look on different devices.

3. Security protocols

Ensure that the eSignature solution complies with the industry’s best practices. It should use encryption techniques like 256-bit AES and SSL encryption to secure all data exchange to and from its web app or site. It should also require users to activate two-factor authentication (2FA) when logging in to multiple devices.

2FA requires the user to provide two ways of authentication to prove their identity. Usually, it has a combination of something they know as a code sent via text message.

4. Compatibility with existing apps and systems

This is another key factor when evaluating an eSignature solution for payroll purposes. This will streamline your HR processes more efficiently between departments. It won’t require extra manual effort or creating redundant data entries or document versions due to incompatible platforms or databases.

5. Cost-effectiveness and performance metrics

You should benchmark each vendor’s pricing structures against one another. Find out if there are long-term commitments involved before purchasing. Choose an eSignature service that offers affordability and flexibility regarding pricing plans.

For instance, you receive a huge discount when paying the annual rate. At the same time, you can downgrade and upgrade anytime, depending on the needs of your business.

eSignature Use Cases in the Payroll Department

Electronic signatures provide the same legal effect as traditional pen-and-paper signatures. You sign documents much faster than traditional methods.

This means quickly processing employee payments and paperwork for businesses: no more expensive courier services or delays due to postal issues. Other use cases will inspire your HR team to switch to eSigning.

Payroll checks

Companies can eliminate printing, mailing, and manual signing from their processes. By automating these steps of the payroll process with electronic signatures both on the check itself and on supporting documents like direct deposit forms. Employers can reduce the time spent processing payroll from days to hours or less.

This save money on labor costs associated with the manual signing and processing of checks. It also reduces risks related to lost or misplaced physical checks.

Tax forms

Tax forms also benefit from electronic signatures since they no longer require physical delivery by mail. They can be signed digitally via secure cloud platforms or apps such as Fill’s eSignature solution. Through Fill,users can upload documents and request eSignatures without hassle.

This eliminates the need for expensive couriers or lengthy delays associated with traditional document delivery methods while ensuring compliance with state and federal tax laws. Additionally, Fill’s platform stores all records securely, so businesses always have access to them if needed in the future.

Employee agreements

This can also be signed electronically using an esignature platform like Fill. This helps ensure that employees fully understand all terms of their contract before signing off on it – something that would be more difficult if you were relying solely on paper documents for agreement purposes.

You can also keep track of the progress of the signature requests, especially those who have signed them already. All data is securely stored within the platform rather than multiple paper copies floating around an office environment.

Benefit enrollment forms

There are other excellent use cases for eSignatures in payroll departments due to their complexity like:

- coverage levels

- eligibility requirements

Employers can easily send out these forms to employees before benefits enrollment periods. The latter can review them at their own pace before agreeing to participate.

This gives employees ample time to understand exactly what benefits they are entitled to receive from their employer before committing. It also prevents potential issues regarding paperwork filing or missing information since everything will be accurately tracked on secure cloud platforms.

Integrating Fill eSignature into Your Payroll System

Your HR processes don’t need to be cumbersome. The Fill app was developed to keep you afloat amidst the pile of paperwork. Treat this service like a Swiss army knife. Aside from easy signing of payroll documents and forms, it helps you manage all files, whether it’s for

- Employee data collection using online forms

- Contract signing and management with templates

- Archiving and organization of files via folders

The ease of integration is unmatched because if you’re already using an existing payroll system, you can connect Fill app via Zapier.

With Zapier, you can connect your Quickbooks account to Fill in just minutes. If you’re using Fill for collecting invoices, then once the contractor completes filling out the form, Quickbooks can create an invoice.

In addition, let’s say you’re using Fill to collect information from newly hired employees. Once the user completes the form, this action will automatically trigger Bamboo HR to create a new employee in your system.

Want to know how Fill can transform your payroll system today? Request a demo, and our team will be happy to walk you through the basics – for free.