The best electronic signature for financial service providers would depend on various factors. You have to consider the level of security needed, its ease of use, and its ability to meet industry requirements. More importantly, it has to live up to the challenge of providing an unquestioned level of trust and assurance.

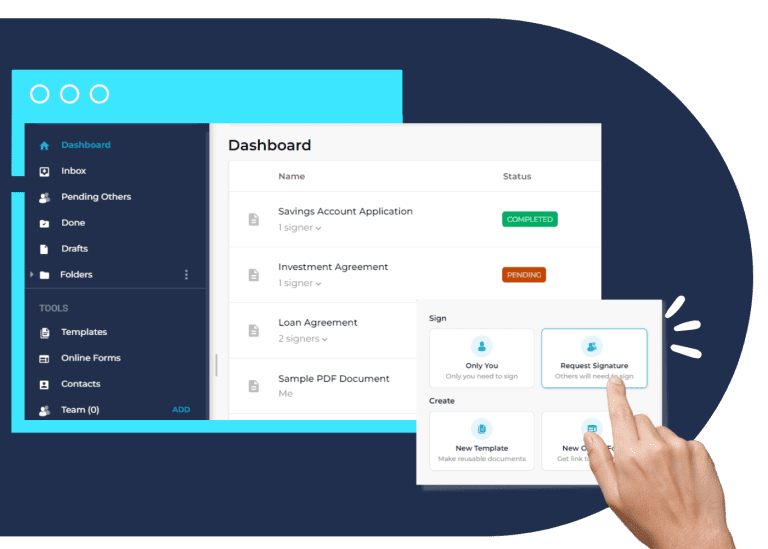

With Fill, you can do more than eSign loan documents and investment contracts. Our cloud-based electronic signature solution includes identity verification, document tracking, and automated audit logs. Thus, you can ensure your documents’ security, authenticity, and legal enforceability.

Undoubtedly, our electronic signature solution provides unmatched convenience, cost savings, and security. Try it out yourself and see how your financial organization can benefit from signing documents digitally.